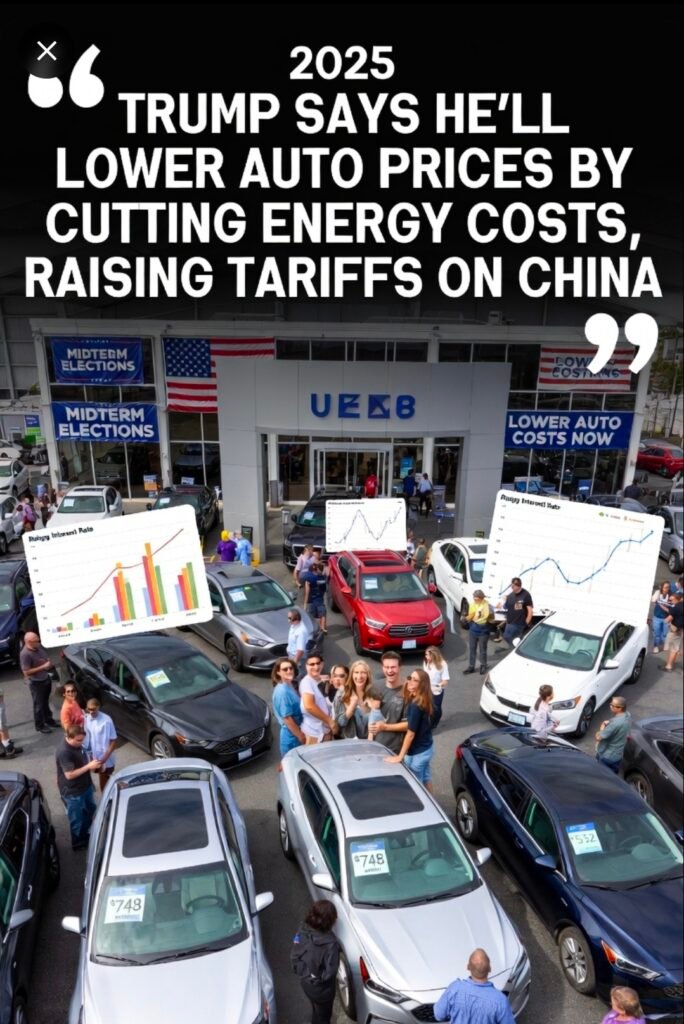

In the third quarter of 2025, the average monthly payment for a new car in the United States hit $748, a notable jump from prior years that has left many consumers feeling the pinch.

This figure represents a roughly 1.8% increase from the same period in 2024, driven by escalating vehicle prices, elevated interest rates, and extended loan durations often stretching to 69 months or beyond.

For used cars, the average payment stands at $532 per month, which, while lower than new vehicles, remains elevated amid persistent market pressures like strong demand and constrained inventory.

These trends have transformed car ownership into a significant financial burden for many households, with payments rivaling the cost of additional rent or other essential expenses.

Factors Fueling the Surge in Car Payments

Several interconnected elements have contributed to this rise. Vehicle prices themselves have climbed due to supply chain disruptions lingering from the pandemic era, inflationary pressures on materials, and a shift toward more feature-rich models, including electric and hybrid vehicles mandated by previous environmental regulations.

Interest rates for auto loans have also remained high, averaging around 6.56% for new cars and 11.40% for used ones in Q3 2025, reflecting broader economic conditions and Federal Reserve policies.

Borrowers are increasingly opting for longer loan terms to manage these costs, but this often results in paying more interest over time, exacerbating the overall expense.The auto market’s dynamics play a role too. Limited used-car supply, partly due to fewer trade-ins from new vehicle purchases during economic uncertainty, has kept prices firm.

Meanwhile, new car production has been hampered by global events, including trade tensions and component shortages. As a result, Americans are grappling with what some experts describe as a “new normal” where vehicle financing feels more like a mortgage than a manageable monthly bill.

Trump’s Recent Policies Aimed at Curbing Costs

Since taking office following his victory in the 2024 presidential election, President Donald Trump has prioritized economic affordability, including targeted measures for the auto industry. One key initiative involves rolling back Biden-era fuel efficiency standards, which Trump argues have inflated manufacturing costs and, by extension, consumer prices.

In December 2025, the administration proposed resetting Corporate Average Fuel Economy (CAFE) standards to more lenient levels, emphasizing conventional gasoline and diesel vehicles over electric mandates. Officials claim this could save consumers at least $1,000 per new vehicle by reducing the need for costly compliance technologies.

Additionally, Trump has advocated for protective tariffs on imported vehicles to bolster domestic production, aiming to create jobs and stabilize prices in the long term.

A new tax deduction on auto loan interest has also been introduced, potentially offering modest savings to borrowers, though its impact is projected to be limited for lower-income households.

These steps are part of a broader agenda to deregulate industries and promote energy independence, which the administration says will indirectly lower transportation costs through reduced fuel prices.

Critics, however, caution that these policies could have mixed outcomes. Relaxing fuel standards might increase emissions and long-term energy costs, while tariffs could raise short-term prices on imported parts and vehicles. Environmental groups argue that the rollback undermines climate goals, potentially leading to higher societal costs from pollution.

Economists note that while deregulation may ease manufacturer burdens, broader factors like interest rates and global supply chains will continue to influence affordability.

The 2026 Midterms: A Potential Turning Point for Further Reforms

Looking ahead, President Trump has framed the 2026 midterm elections as a pivotal moment centered on affordability and pricing issues, predicting that voters will reward Republicans for efforts to lower everyday costs.

With control of Congress at stake, a Republican sweep could enable the passage of additional legislation to build on current auto policies. For instance, stronger majorities might facilitate expanded tax incentives for domestic manufacturing, further deregulation of the industry, or subsidies aimed at reducing production costs—potentially translating to lower vehicle prices and financing burdens.

Trump has emphasized that GOP victories would accelerate initiatives like energy price reductions, which could indirectly benefit the auto sector by cutting manufacturing and fuel expenses.

Promises include slashing energy costs by half, which supporters argue would ripple through to cheaper cars. If Republicans maintain or expand their influence, they could also push for reforms to auto loan structures or incentives for shorter-term financing to combat the trend of extended payments.

On the flip side, a divided Congress or Democratic gains could stall these efforts, preserving or reinstating stricter regulations that some view as essential for innovation and sustainability.

Voter sentiment on affordability remains a wildcard, with recent data showing widespread concern over high costs despite economic growth claims. As the midterms approach, the auto industry’s fate may hinge on whether these promises resonate amid ongoing economic pressures.

In summary, while 2025 has seen car payments reach new heights, the Trump administration’s policies offer a framework for potential relief.

The 2026 midterms could amplify these effects if they result in aligned congressional support, but outcomes will depend on broader economic trends and policy execution. Consumers are advised to monitor interest rates, shop competitively, and consider alternatives like public transit or car-sharing to mitigate costs in the interim.